1. Be Aware

Your first step when jumping into the Cryptocurrency market is to ensure you understand what it is, how it works and what the potential benefits and disadvantages are. Like any market, researching the history of Bitcoin and other altcoins will give you an in-depth look at the current state of the market and provide insight on whether now is the time to buy, sell or hold. As the Cryptocurrency market is so volatile, researching is essential. Most professional brokers and investors aren’t even able to predict where the market is heading as it changes so quickly!

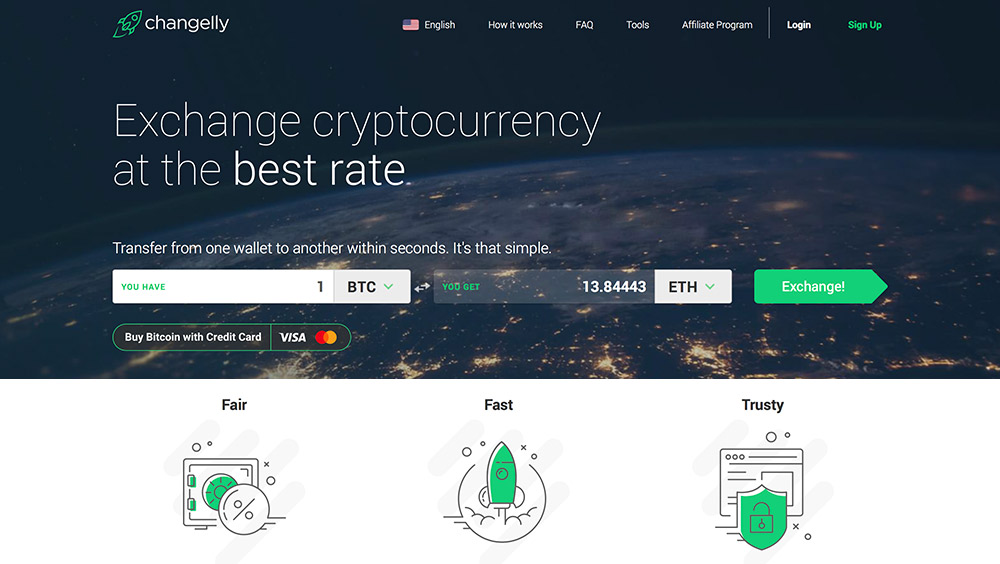

2. Understand the Exchanges

Cryptocurrency trading is new compared to trading stocks on the ASX or NYSE, so important to understand how each program and trading website works. We recommend some time to make a mock account on Changelly (or any of the other Crypto trading sites) to practice and learn how the software works before you commit to actually placing a trade. Another note to make on the altcoin exchange process is that, unlike traditional currencies, Cryptocurrency trading can take hours to settle – so don’t panic if your trade or purchase isn’t completed right away.

When dealing with

CRYPTOCURRENCIES

The rules are DIFFERENT

3. Understand Value

The Cryptocurrency market has been in the firing line of the world’s top investment firms for being so volatile, or even for being a ‘’bubble’’. Understanding how the price of altcoins is affected can be rather confusing, but simply speaking: the price of each coin is generally affected by the others. As Bitcoin grows in value for instance, the major altcoins (Ripple, Litecoin, Ethereum) have generally followed the same trend.

And more…

4. Minimise Diversity

Generally, when trading, diversity is good, though when dealing with the rules are different. Altcoins normally rise and fall in synch with each other, though, some more than others. When dealing with Cryptos, the safer and more choice is to heavily research and determine the best currency for you and invest (as much as you’re prepared to lose) into that one currency.

5. Don’t Cash Out Right Away

If your reason for investing was for a profit and you plan on watching the market and seeing how far your investment can take you, then don’t instantly cash out as soon as there is a major jump in price. With such high volatility levels it’s easy to be caught up in a quick profit when the price jumps, though, there may be far more potential in the long term and it is recommended that you leave your and wait for a second or third jump, which are, historically speaking, far larger than the initial jumps.

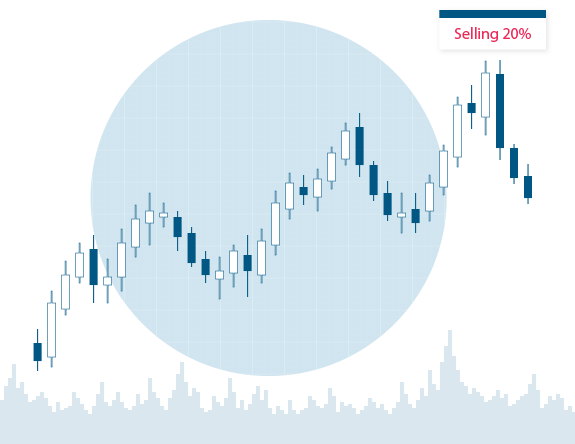

6. Is a High a real High?

A complex process in the cryptocurrency investment business is determining when a high is actually high, and when lows are low. As Cryptocurrencies are fairly new, and new ones are being released on a monthly basis, the market is still yet to show any signs of consistency. When planning to sell, clearly check all markets for signs of an incoming spike, or drop – or an impending high growth period. Altcoins are heavily controlled by public perception, professional opinion and press releases, so stay aware. Leading investors also recommend only selling 20% of your stock on a high, as another high could be just around the corner.

7. Be Wary of Exchanges

Some good questions to ask yourself when searching for a cryptocurrency exchange application or website, are;

As the Crypto boom has generated hundreds of billions of dollars from coin holders, a number of scams and fake exchange platforms have popped up, so it is essential that you are entirely certain that your chosen exchange platform is authentic.

8. Develop a Stop & Trade Plan

In a volatile market, you must set a clear stop and trade plan. Just because altcoin is showing unhindered growth doesn’t mean it’ll continue forever. In fact, it could stop entirely. A Stop and Trade plan simply suggests – when your coin has reached your target price you stop and sell some of it. These sold coins are what prevents you from an entire loss if your coin collapses in value. This plan is essential for Cryptocurrencies as their price jumps aren’t in the 2-3% range, they’re normally 60%-80%.

Highly risky to

Leave coins an an EXCHANGE

9. Keep your Coins Secure

When you buy a coin you have two ways to store your coins, on the exchange or in a digital wallet. Though, it is highly risky to leave coins on an exchange as tens of millions of coins have been stolen in recent months. A leading altcoin analyst, Jacob Eliosoff, told Forbes that its fine to buy, “on an exchange like Coinbase, but then move your coins into an online wallet like blockchain.info/wallet/, a mobile wallet like Jaxx or Coinomi, or create a paper wallet – all free and pretty easy.” There’s a diverse array of wallet types to suit almost everyone, and there are also online and offline versions for secure storage.

10. Choose a Wallet

Choosing your Bitcoin or altcoin Wallet will depend on your own individual security requirements as well whether you’re a long-term or short-term investor.

Major cryptocurrency wallet types include:

Paper Wallets

Printed sheets of paper, similar to traditional funds, although they feature QR or other codes. They are also generally unsafe.

Hardware Wallets

These are physical and are stored in USBs or similar devices. These devices hold the keys to the funds or each fund individually. They are kept offline and not connected 24/7 and therefore are unaffected by malware and other attacks.

Cold Wallets

Simply put, cold storage is the removal of the coins from any connected or active digital device, like paper or a disconnected USB.

Hot Wallets

Similar to a cold wallet, a hot wallet is a storage type that is connected to the internet. This wallet type is useful for those who wish to spend and exchange their coins frequently, though it does come with security risks.

Multi-signature Wallets

These wallets require more than one signature before a Bitcoin or altcoin transaction can proceed, thus making it more difficult for someone to steal or transact coins.

11. Secure & BackUp Devices

If you’ve decided that an offline wallet is the best option for you, there are also a few things you should know. Your chosen storage device must be kept extremely secure and backed up. An example is if your computer hardware fails and you’ve lost all files on your hard drive, then you’ve also lost all of your coins. A backup online, or to a separate hard drive is essential. Encryption is also vital in case someone steals the device, though, they are able to destroy all coins just by ruining the device, further promoting the idea of a backup.

12. The Media Affects Pricing

The traditional stock market is affected by the media and by press releases, but altcoins are far more susceptible to price changes from media releases. Following a press release from companies announcing the acceptance of altcoins, prices have recently surged exponentially. If you’re planning on turning a profit from Bitcoin or its numerous rivals like Ripple, Ethereum or Litecoin, you must stay updated with media releases. These releases will often determine when to buy and sell. It also gives you an insight into why your coin value fell and whether it might come back up.

13. New Laws & Regulations

14. Check transaction & exchange fees

Every few weeks, or on a monthly basis, transaction fees for Bitcoin and altcoin purchases grow and it’s important to know these costs. The transaction costs rise often due to the higher demand and increased use of altcoins for purchases. Cryptocurrency transaction fees are usually imposed when a business or exchange wishes to reduce demand and push transactions through in a shorter period of time. As well as this, digital wallet providers may also charge fluctuating transaction fees which could dig into your profits, so it is important to check these fees also.

Cryptocurrency

trading times are NON-STOP

15. Make a Trading Schedule

Cryptocurrency trading times. are entirely different to traditional times, as they trade 24 hours a day, 7 days a week. It’s non-stop, which can make it difficult to detract yourself from constantly watching the prices and endlessly buying and selling coins, no matter which altcoin you’re investing in. It’s important to set up a timeframe for when you want to watch the market and buy or sell coins, otherwise, you’ll find yourself losing sleep, and becoming entirely addicted to the process. Try to pick appropriate times to trade or monitor, such as normal work hours, or spare some time before or after work.

16. Don’t Always Sell Immediately

A major mistake that many beginner investors make is buying or selling immediately when there is a swing in the stock price in an attempt to minimise losses and maximise profits. Though, with altcoins, these swings are often so large that they can climb a lot further than your selling point. This leaves the investor without any coins, and a high re-buying price. Specifically, with regard to cryptocurrencies, buying and selling a large amount, or overtrading, can inflict massive exchange fees which will consume a large chunk of your profits. You could also miss out on future gains if you’ve sold all of your holdings.

17. Choosing a Long-term Coin

18. Ripple, Litecoin & Ethereum set for Longterm

As the traditional banking system is so regulated a simple transfer to another bank is a long and bothersome process. Three major altcoins are attempting to fix this; Ripple, Ethereum and Litecoin. All listed by Wealth Daily as being the major players, besides Bitcoin, for the future of cryptocurrency. These altcoins aren’t limited by a set number of coins, so over time, their price has the ability to become stable and integrate into the world’s financial system. Ripple even allows for seamless transfers, no matter where in the world an individual is, or which bank they’re with. It’s also important to know that Ripple is a favourite with banks, and numerous banks are accepting Ripple.

Split your overall

INVESTMENT fund

into SMALL parts

19. Trickle Investment Buying

20. Prepare for Bank Backlash

Altcoins are a major threat to bank dominance in the finance business and therefore banks will continue to fight back against cryptocurrencies in their attempts to remove the threat. You should be aware of this as bank press releases designed to affect cryptocurrencies will cause swings in price and you’re less likely to be concerned if you understand what created these swings.

21. Be Wary of Scams

You should be cautious of scams, fake online forums and brokers who aren’t directly buying cryptocurrencies and using your funds in other ways to buy coins. It is vital that you utilise known, reputable and established sources for your trading, like Coinbase. Hedge funds are also rife with crime and high-risk practices. The assumption that you will receive a profit from supplying a broker with large sums of money is popular, though the risks in the cryptocurrency space are massive. Always check sources and be certain that your choice of brokers, hedge funds and buy recommendation forums are authentic.

22. Don’t Be Tempted by Leverage

As some coins are valuable it’s tempting to use broker loans or leverage, to invest in cryptocurrencies. Although this gives you the ability to boost your profits, it can also result in increased losses if the market shifts negatively. It’s important for beginner investors to steer clear of broker loans as leverage can increase the risks of trading to more than your initial deposit. You should initially always use your own funds to learn the market and keep your losses as low as you can.

23. Stay Informed & Follow Theory

In short, trading a cryptocurrency is similar to trading Forex. You’ll find exchanges and traders all online, and very similar rules apply in crypto trading that apply in Forex currency trading. Unlike Forex though, almost all of the cryptocurrency space is less than a decade old, unregulated and prices can show a wild volatility. This is expected to cool off over the next few years when the coins are more integrated into commerce and acceptance becomes ubiquitous. All investors should stay well informed and learn the theory behind traditional trading as well as the new rules that investors are discovering are unique to cryptocurrencies.

Asking questions

lets you DETERMINE

If its a good idea to invest in that STOCK

Learning to Trade

Trading stock is simply the act of buying a company’s stock on an exchange at a low price and selling it when the price is at a high price to make a profit. But, there is a number of variables you need to consider when trading traditional stocks, currency or cryptocurrency, and that is, the current and future state of the market.

Once you’ve determined a stock or number of stocks you want to invest in, you need to find an exchange with that stock. The exchange where you’ll find the majority of Australian stocks is the Australian Securities Exchange or ASX.

The above questions should give you a brief overall summary of the stock and let you determine if its a good idea in both the short and long-term, to invest in that stock.

Trading on the

FOREX is normally a

STOCK EXCHANGE

Forex Trading

If you’re deciding on Forex trading you should know the general basics. You should look to find a currency which is currently at a low point (or expected to grow) and buy it. Once your currency has made some gains you can then sell it back at a high & what’s left over is your profit.

There are a number of things to consider when trading on the Foreign Exchange, and that is the stability of the nations where your currency is located. An unstable political climate can have disastrous effects on the worth of your currency.

FXCM is a great resource for Forex trading which can give you price insights and a simple way to trade international currencies.

If you are interested in learning more about trading Forex be sure to visit the World’s #1 Trading Experts Learn to Trade.